Top Mobile Antivirus for Safe Banking in USA

- Best Security Features for Banking Protection

- Top Mobile Antivirus for Safe Banking in USA: A Comprehensive Guide

- What antivirus solutions are commonly recommended by financial institutions for mobile banking security in the United States?

- Why is mobile antivirus protection considered essential for secure online banking transactions?

- Which mobile antivirus applications offer the most comprehensive security features specifically for banking activities in the US market?

- More information of interest

- What are the key features to look for in a mobile antivirus for banking in the USA?

- Which mobile antivirus apps are most recommended for banking security in the USA?

- How does a mobile antivirus protect my banking transactions?

- Are free mobile antivirus apps sufficient for protecting banking activities in the USA?

Top Mobile Antivirus for Safe Banking in USA, as digital banking becomes integral to daily financial management, securing mobile transactions against evolving cyber threats is paramount. This article examines the top mobile antivirus for safe banking in USA, focusing on solutions that provide real-time protection, phishing detection, and secure browsing features tailored for American users.

With increasing incidents of mobile fraud, selecting a robust antivirus is critical to safeguard sensitive banking data. We analyze key factors such as efficacy, user experience, and compliance with U.S. banking regulations to help you choose the best defense for your financial activities on smartphones and tablets.

You may also be interested in reading: Top Premium Antivirus for Secure Devices USA

Best Security Features for Banking Protection

When selecting a Top Mobile Antivirus for Safe Banking in USA, it's crucial to evaluate the specific security features designed to protect financial transactions. Leading antivirus solutions offer real-time scanning, phishing protection, and secure browsing environments that create a protective barrier between your banking information and potential threats. These specialized features monitor app behavior, detect suspicious network activity, and prevent unauthorized access to sensitive financial data, ensuring your mobile banking experience remains secure against evolving cyber threats.

Real-Time Threat Detection Capabilities

Modern Top Mobile Antivirus for Safe Banking in USA solutions employ advanced real-time scanning that continuously monitors your device for malware, spyware, and banking trojans. These systems use behavioral analysis and machine learning to identify new threats before they can compromise your financial data. The instant detection and quarantine of suspicious files ensure that your banking applications remain protected from zero-day attacks and sophisticated malware designed specifically to target financial transactions on mobile devices.

Secure VPN Integration

Premium mobile antivirus solutions include integrated VPN services that encrypt your internet connection, providing an essential layer of security when accessing banking services on public Wi-Fi networks. This feature prevents hackers from intercepting your sensitive financial information by creating a secure tunnel for data transmission. The VPN ensures that your banking activities, login credentials, and transaction details remain private and protected from eavesdropping attempts on unsecured networks.

Anti-Phishing Protection

Advanced anti-phishing technology in top antivirus applications specifically targets banking-related fraud attempts. These systems analyze websites and emails for suspicious characteristics, warning users before they enter credentials on fake banking portals. The protection extends to SMS phishing attempts and malicious links that could compromise your financial accounts. This feature is particularly critical for mobile banking users who might encounter sophisticated phishing schemes designed for smaller screen interfaces.

App Permission Monitoring

Comprehensive antivirus solutions monitor and control application permissions that could potentially access your banking information. These systems alert you when apps request unnecessary permissions to your contacts, messages, or other sensitive data that could be exploited for financial fraud. By managing app permissions and detecting suspicious behavior, this feature prevents malicious applications from gaining access to your banking credentials or transaction verification codes.

Transaction Security Features

Specialized banking protection modules within top antivirus solutions provide additional security layers during financial transactions. These features include secure keyboards that prevent keylogging, screen overlays that block screenshot attempts, and transaction verification systems that ensure the legitimacy of payment requests. The protection extends to monitoring for unauthorized transactions and providing instant alerts for any suspicious banking activities detected on your device.

| Feature | Protection Level | Banking Specific |

| Real-Time Scanning | High | Yes |

| Secure VPN | High | Yes |

| Anti-Phishing | Critical | Yes |

| App Monitoring | Medium-High | Yes |

| Transaction Protection | Critical | Yes |

Top Mobile Antivirus for Safe Banking in USA: A Comprehensive Guide

What antivirus solutions are commonly recommended by financial institutions for mobile banking security in the United States?

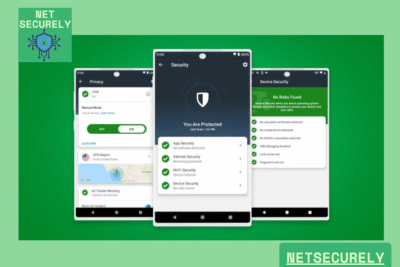

Financial institutions in the United States commonly recommend comprehensive mobile security suites that integrate antivirus, anti-malware, and real-time threat protection, with solutions such as Symantec Norton Mobile Security, McAfee Mobile Security, and Bitdefender Mobile Security being frequently endorsed due to their robust encryption, phishing protection, and secure browsing features specifically designed for banking activities; these platforms often include additional layers like multi-factor authentication and transaction monitoring to safeguard against unauthorized access and financial fraud, ensuring alignment with regulatory standards and providing users with reliable tools for the Top Mobile Antivirus for Safe Banking in USA.

Key Features of Recommended Mobile Antivirus Solutions

Financial institutions emphasize antivirus solutions that offer real-time scanning, phishing protection, and secure VPN integration to encrypt data transmissions during banking sessions. These features are critical for detecting malware targeting financial apps and preventing interception of sensitive information. Additionally, anti-theft capabilities such as remote wipe and location tracking are often highlighted to protect devices in case of loss or theft, ensuring comprehensive security beyond mere virus detection.

Popular Antivirus Brands Endorsed by U.S. Financial Institutions

The most frequently recommended brands include Norton by Symantec, McAfee, and Bitdefender, all of which offer dedicated mobile security suites with banking-specific features. These brands are trusted for their proven track records in threat detection and compliance with financial industry standards. Below is a comparison of their key offerings:

| Brand | Key Feature | Banking Protection |

|---|---|---|

| Norton | Real-time malware scanning | Secure VPN for transactions |

| McAfee | Wi-Fi security alerts | Encrypted storage for passwords |

| Bitdefender | Web protection | Anti-phishing for banking apps |

Implementation and Best Practices for Users

Financial advisories stress the importance of regular updates and user education alongside installing antivirus software. Users are advised to enable automatic scanning, avoid public Wi-Fi for banking, and utilize app-specific permissions to limit access to sensitive data. Institutions often provide guidelines to ensure the antivirus is configured to prioritize banking apps, such as activating transaction security modes and verifying app authenticity through official stores.

Why is mobile antivirus protection considered essential for secure online banking transactions?

Mobile antivirus protection is considered essential for secure online banking transactions because smartphones and tablets are increasingly targeted by sophisticated malware, phishing attacks, and unauthorized access attempts that can compromise sensitive financial data; these security solutions provide real-time scanning, detect malicious applications, encrypt communication channels, and prevent identity theft by blocking fraudulent websites, thereby ensuring that login credentials, account details, and transaction authorizations remain protected from cybercriminals who exploit vulnerabilities in mobile operating systems and unsecured networks.

Protection Against Malware and Spyware

Mobile antivirus software is vital for defending against malware and spyware specifically designed to steal banking information, as these threats can log keystrokes, capture screens, or hijack sessions without the user's knowledge; advanced antivirus programs use behavioral analysis and heuristics to identify and quarantine such malicious code before it can exfiltrate data or gain unauthorized access to financial apps, with some of the Top Mobile Antivirus for Safe Banking in USA offering additional features like anti-tracking and secure browsing to enhance privacy during transactions.

Secure Connection on Public Networks

Using public Wi-Fi for banking transactions exposes users to risks like man-in-the-middle attacks, where hackers intercept data transmitted over unsecured networks; mobile antivirus protection often includes integrated VPNs or network scanners that encrypt internet traffic and alert users to vulnerabilities, ensuring that sensitive information such as account numbers and passwords is not compromised even when accessing online banking from airports, cafes, or other public locations with unreliable security.

Phishing and Fraud Prevention

Antivirus applications play a critical role in identifying and blocking phishing attempts, which are fraudulent emails, messages, or websites mimicking legitimate banks to trick users into revealing login credentials; these tools employ real-time URL filtering, anti-phishing databases, and AI-driven detection to warn users before they interact with suspicious links or input personal information, significantly reducing the risk of financial fraud and identity theft associated with social engineering attacks targeting mobile devices.

Which mobile antivirus applications offer the most comprehensive security features specifically for banking activities in the US market?

For comprehensive mobile security specifically tailored to banking activities in the US market, Norton Mobile Security, McAfee Mobile Security, and Bitdefender Mobile Security stand out as top contenders, offering robust features including real-time protection, secure VPN services, anti-phishing technology, Wi-Fi security scanning, and dedicated banking protection modes that create encrypted environments for financial transactions; these applications consistently receive high ratings for their ability to safeguard sensitive data against malware, spyware, and unauthorized access, making them the Top Mobile Antivirus for Safe Banking in USA due to their multi-layered defense systems and compliance with US financial security standards.

Key Security Features for Banking Protection

The most critical security features for banking-focused mobile antivirus applications include real-time malware scanning, anti-phishing protection, secure VPN integration, and transaction security encryption. These applications typically employ behavioral analysis to detect suspicious activity and sandboxing technology to isolate banking apps from potential threats. Additionally, features like Wi-Fi network security alerts and identity theft protection are essential for comprehensive safety, ensuring that users' financial data remains protected during online banking sessions against both known and emerging threats.

Performance Comparison of Leading Applications

When evaluating performance, Norton Mobile Security demonstrates exceptional malware detection rates and minimal impact on device performance, while McAfee offers strong phishing protection and integrated identity monitoring. Bitdefender is renowned for its lightweight operation and advanced fraud prevention capabilities. The table below summarizes key performance metrics:

| Application | Malware Detection Rate | Banking Protection Feature | System Impact |

|---|---|---|---|

| Norton Mobile Security | 99.9% | Secure VPN & Transaction Scanning | Low |

| McAfee Mobile Security | 99.8% | Wi-Fi Guard & Anti-Theft | Moderate |

| Bitdefender Mobile Security | 100% | Account Privacy & Web Protection | Very Low |

User Considerations for US Banking Security

US banking customers should prioritize antivirus solutions with strong compliance with domestic financial regulations and responsive customer support for immediate threat assistance. Important considerations include compatibility with major US banking apps, regular updates to address region-specific threats, and minimal false positives that could disrupt legitimate banking activities. The ideal application should also offer clear incident reporting and data breach notifications specifically tailored to the US financial ecosystem to ensure timely responses to potential security incidents.

More information of interest

What are the key features to look for in a mobile antivirus for banking in the USA?

When selecting a mobile antivirus for safe banking in the USA, prioritize apps with real-time scanning, anti-phishing protection, and Wi-Fi security. Additional critical features include app-locking for financial applications and secure browsing capabilities to protect your sensitive banking information during transactions.

Which mobile antivirus apps are most recommended for banking security in the USA?

Highly recommended antivirus apps for banking in the USA include Bitdefender Mobile Security, Norton Mobile Security, and McAfee Mobile Security. These apps are recognized for their comprehensive protection, banking-specific features, and strong performance in independent security tests relevant to the U.S. market.

How does a mobile antivirus protect my banking transactions?

A mobile antivirus safeguards your banking transactions by employing encrypted connections through a secure VPN, blocking malicious websites and phishing attempts, and scanning for malware that could intercept your data. It ensures that your financial data remains confidential and secure from potential threats during online banking activities.

Are free mobile antivirus apps sufficient for protecting banking activities in the USA?

While some free mobile antivirus apps offer basic protection, they are generally not sufficient for comprehensive banking security. Premium versions provide essential features like advanced phishing protection, secure VPNs, and dedicated banking modes, which are critical for safeguarding against sophisticated threats targeting financial transactions in the USA.

Deja una respuesta